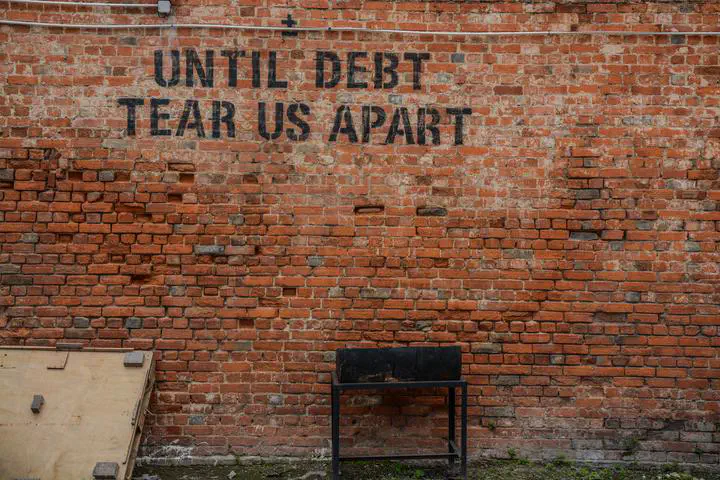

Photo by Peter Herrmann on Unsplash

Photo by Peter Herrmann on Unsplash

Abstract

This paper offers a straightforward and descriptive contribution to the recent and busy debate on fiscal discipline made popular by the seminal Reinhart and Rogoff (2010; Growth in a time of debt. American Economic Review, vol. 100, no. 2, 573–78) paper, after policymakers have sought foundation and justification for a policy known as austerity measures, following on from the sovereign debt crisis of 2010. We revisit the debate on whether or not higher debt levels impede growth rates and offer a time series perspective of a corrected data set and a more recent higher-frequency source. We find that with further hindsight, and from a time series perspective, there is little to no support for the view that higher levels of debt cause reductions in economic activity. In contrast to Reinhart and Rogoff (2010), we suggest that economic slumps tend to cause debt build-ups rather than vice versa.